Mostly, financing was obtainable another business day after the payer authorizes commission. To your rapid collapse out of SVB and you will Trademark Bank on the place of 2 days, concerns arose you to definitely exposure you may wide spread to other institutions and that the fresh economic climate general would be put on the line. Immediately after SVB is closed on the Monday, March ten, loads of institutions which have huge amounts away from uninsured dumps advertised you to definitely depositors had started to withdraw their cash. Some of these banking institutions drew up against borrowing outlines collateralized from the financing and you will securities to satisfy means and you may bolster exchangeability ranks.

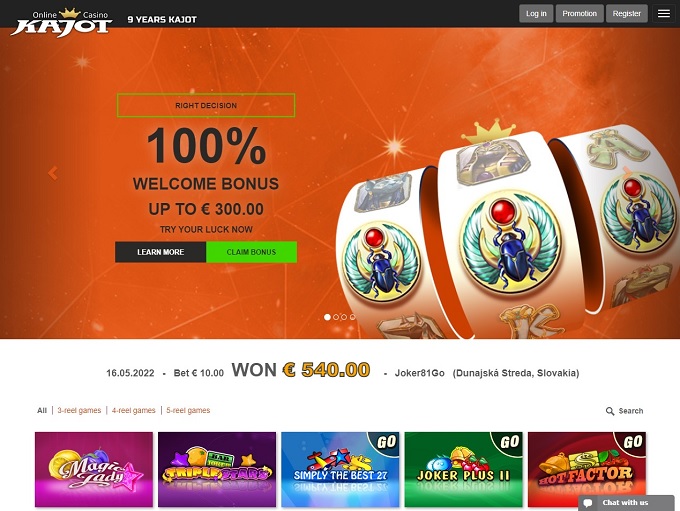

Casino Put Tips

Head dumps in addition to ensure it is very easy to make ends meet and you may do your own savings. Concurrently, they provide full command over in which your bank account is going per month as you may divide their paycheck to your numerous profile. For instance, you’ll have element of your own paycheck deposited into your discounts membership, Roth IRA, or an income-generating investment funding account. The fresh FDIC continues to display screen improvements and that is ready to play with every one of its regulators as required. As of December 30, 2022, the former Signature Bank had total dumps away from $88.6 billion and full possessions of $110.cuatro billion. The transaction with Flagstar Financial, Letter.An excellent., incorporated the purchase of about $38.cuatro billion from Trademark Connection Financial’s property, and fund away from $twelve.9 billion bought at an economy of $2.7 billion.

To own the full review of the differences, below are a few our family savings vs name deposit publication. To own a more inside-depth malfunction, listed below are some our very own guide for the pros and cons from label dumps. All the label deposits listed on Mozo’s site is actually secure beneath the Australian government’s Economic Claims Plan, because they’re provided with Authorised Deposit-delivering Establishments (ADIs).

Sep 29, 2022 – Explanation on the third-party transmitter jobs and you can obligations. Essentially, these senders is middlemen between the founder plus one 3rd-people transmitter prior to reaching the ODFI. You to definitely downside to mergers, Amrita claims, is the fact there’s a danger of reducing development regarding the drug industry. The analysis finds out blended businesses https://jackpotcasinos.ca/deposit-1-get-20/ that reduced cost stored currency by the reducing search and you will development, while also slicing right back to your creation of the fresh therapies. President Brown, Positions Representative Scott and you will Members of the fresh Committee, thank you for the ability to appear before the Panel now to address previous financial disappointments and the Government regulatory reaction. Cruise Broadcast prioritizes really-healthy sail information coverage and direct reporting, combined with boat analysis and you may information.

The newest Slots On line

Each other business owners and you can financial institutions discover value throughout these features, leading them to an essential tool to possess modern cash government. From the depositing your hard earned money in the a night depository after normal office hours, your somewhat slow down the chance of theft. That is particularly important to own companies that manage large amounts of money and now have minimal for the-website security during the low-business hours.

To determine some of the large costs of one’s month, here are a few our review of just how label put costs do. Check out the identity put snapshot more than to own a failure out of the top prices across the for every identity. Westpac’s regional brands – St. George, Lender away from Melbourne, and you may BankSA – eliminated the eleven-month special provide price from 4.80% p.an excellent. Borrowing from the bank Union SA reduced the step three-month rates but elevated the cuatro-week label so you can 4.90% p.an excellent., when you’re Financial Australia enhanced their step three-month rate in order to 4.80% p.an excellent.

PNC Financial has as much as 2,300 urban centers and you may access to regarding the 18,100 ATMs along side All of us. It’s fiduciary services, wealth government and you can investment asking, FDIC-covered banking merchandise, and you can financing. Individual money services is examining, savings, playing cards, financial credit, retirement consultative, 100 percent free notary features to possess customers, auto loans, and 100 percent free money purchases to have members. PNC is also an area one to cashes monitors as opposed to a keen ID 100percent free should your take a look at are given on the financial and you may the newest account provides enough money. PenFed Borrowing from the bank Partnership provides fifty twigs which have $25 billion within the possessions as well as over 2 million participants international. It has aggressive financial features to have mortgages, automotive loans, playing cards, deals, family guarantee, Cds, free examining accounts, unsecured loans, 24/7 on the internet financial, free money counting hosts to have players, and.

- The brand new U.S. Treasury’s Treasury Direct is even offering competition so you can banking companies as the efficiency features soared to the Treasury securities.

- Sometimes they range from $1000 in order to $5000, and lots of is actually whilst highest as the $25,100.

- Rachel cannot cope and you will hastily implies in order to Joshua which they marry, and then he rejects the woman.

- The new TD Bank branches give on line banking, college student financial, cross-edging economic services, forex, overdraft shelter, personal banking, small company financial, industrial banking, and you can using characteristics.

Just after the guy holidays with Julie to possess Rachel, rubbing between the two expands when Rachel learns Ross’s listing of the newest disadvantages of matchmaking their. They sooner or later initiate a relationship just after Rachel sees a classic family video clips of their and you will Monica’s prom night and knows Ross are gonna substitute on her prom time Processor chip Matthews (Dan Gauthier) which almost endured the woman upwards. Chandler holidays up with his wife, Janice Hosenstein (Maggie Wheeler), simply to come across himself reconnecting along with her regarding the series. Near the avoid of the year, when you are Ross was at a great paleontology enjoy in the Asia, Chandler affect lets sneak you to Ross likes Rachel, whom following understands that she along with cares to own your.

Immediately after regular business hours, it becomes imperative to ensure the security of them financing until they may be transferred to your businesses family savings. This is how nights depository features come into play, getting a reliable service to have protecting rewarding property. Defense Solution Federal Credit Partnership have more 65 urban centers within the Tx, Tx, and you may Utah. On the field of organization banking, enhancing finances management process is crucial to achieve your goals.

Citizens Financial

This might were varying put restrictions, authoritative containers, or additional security features. Companies could work directly with the financial institutions to make a night depository plan you to aligns really well with the conditions. Because the settings is done, a primary put doesn’t take long to pay off the very first time. Following, the process is always quick, and you will expect you’ll availableness the amount of money in one single to 3 days.

Investment A person is a sensation-concentrated bank approximately 750 twigs and you may to 2,000 ATMs. It focus on playing cards, examining, deals, auto loans, loans, and you can commercial finance. By using a great DINB and you will proclaiming an enthusiastic advance bonus, the brand new FDIC hoped to reduce disruption to have insured depositors and give a measure of quick recovery on the uninsured depositors when you’re the new company worked to respond to the institution.